Bitcoin and Crypto Bear Market, The biggest factor in the performance of the blockchain is the price. It is critical to have a high enough value to attract investors, and it is critical for the network to remain viable and profitable. When you invest in crypto, you are gambling not just on the price of the cryptocurrency, but whether or not it will continue to exist. The price could go down pretty quickly, so if the price goes down you could make a lot of money very quickly.

The cryptocurrency market is volatile and it’s common to see large corrections or even crashes happen on a daily basis. It’s tough for new sellers to get in now, especially in the early days. Our goal is to make sure you aren’t missing out on the next big bull run by predicting it too soon, so we’ve been publishing daily analysis of the cryptocurrency market. We take a look at the overall health of the market, the top coins by market cap, and the key trends shaping the market.

1. How to use a stock chart to predict the future price of crypto assets

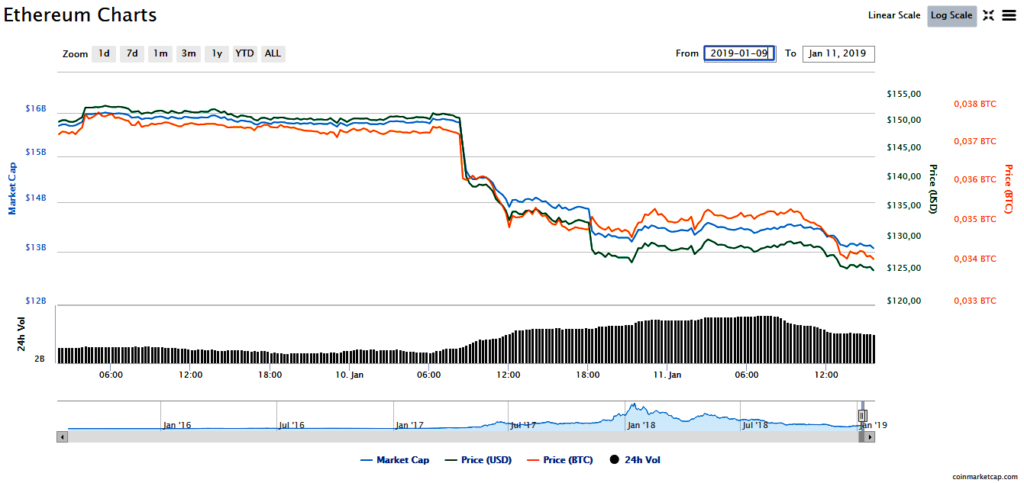

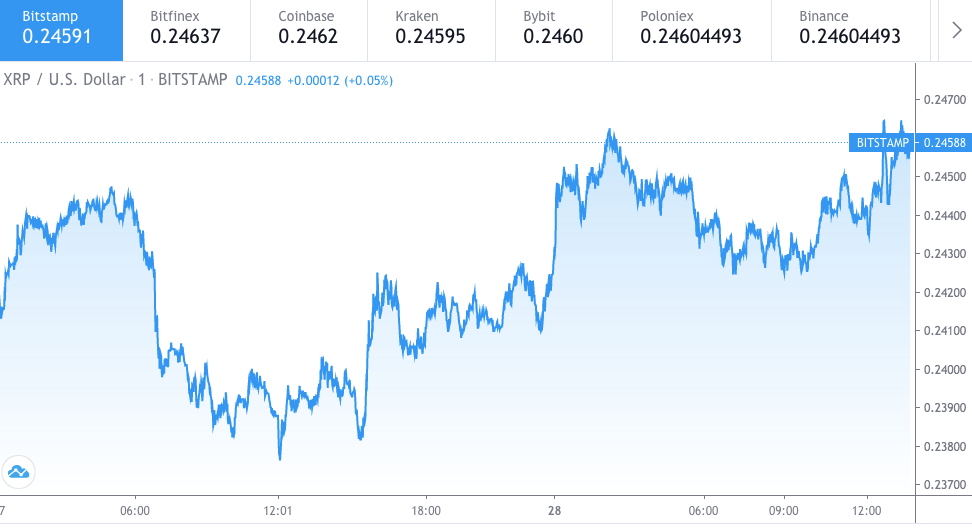

Crypto Bear Market, A stock chart (like the one below) shows the price movements of an asset over time. A stock chart helps you identify trends in the assets’ movement. The longer the line on the graph, the greater the increase in the value of the asset over the time period compared to its original value at the 1.For example, on May 21, 2017, the S&P 500 closed at 2, 1.On July 11, 2017, the S&P 500 closed at 2, In July of 2017, the price of the S&P 500 increased 0.8%. A longer line indicates that there’s a lot of competition among retailers.

2. How to predict a cryptocurrency’s trend by analyzing historical trends on a given time frame.

Crypto Bear Market, There are several ways to predict the potential price of a cryptocurrency and find out what to do next. Some of the technical aspects you need to understand about using moving average are: the simple linear regression (SLR), exponential moving averages (EMA), and moving averages (MA). The Long-Term Regression Model (or LTR model) uses the long-term correlation between two given variables to predict future trends. In this case, Bitcoin and Ethereum. On the other hand, the EMA model uses a mathematical equation that predicts how prices of a given asset will perform in the near future. It is an interesting approach. I’m not sure why it is necessary or useful.

3. Bitcoin Price Prediction – BTC, ETH and BNB outlooks based on technical analysis.

Bitcoin prices have been on the up recently, but they’ve experienced a correction to the downside recently. Let’s look at the daily chart below. We can see a bullish breakout from an ascending triangle formation. A break below the triangle will open the door for additional downward pressure on the market.

The price has bounced off the support trend line but is still above the resistance line, so the price could consolidate for a few hours or days as the buyers A stock will be trading at a lower price soon, so expect volatility to increase. This means opportunities will arise for traders to buy and sell. I have my eye on the big prize, and am ready to strike when it does.

4. Forecasting Crypto Asset Price Trends Using Technical Analysis

To know what makes crypto assets tick, one must first understand the fundamentals of technical analysis. Technical analysis is based on the assumption that investors trade not only the price of an asset, but its direction. Trends are visible patterns or trends that repeat themselves over time. These patterns, which are often identified through charting techniques such as candlestick, bar, and line, can be used to predict market movements and determine if the price of an asset will go up or down in the future.

5. Market Sentiment & Technical Analysis – What Is a Bullish or Bearish Trend

The second principle in our list of three is market sentiment. You can have a bullish market sentiment or bearish market sentiment. A bullish market sentiment means a positive outlook for the stock. A bearish market sentiment means a negative outlook for the stock. A positive market sentiment means that people are more optimistic about the company’s future performance. When you have a negative market sentiment, it’s usually because there’s been a major economic downturn or a disappointing earnings report.

6. Forecast: Cryptocurrency Price Predictions 2020, 2021 and 2022

Crypto markets are bullish over the next three years. Many people believe the price of cryptocurrency will reach a value of $1 trillion by 2025. Bitcoin and Ethereum will continue to rise in popularity, but the dominance of Bitcoin will not change. Investors are betting on the blockchain technology that is being used in the Ethereum network and other similar networks.

Interested in Reading My Article On Analyst Says Ethereum, Polkadot and Four Additional Crypto Assets Are Top Altcoin Picks for Accumulation